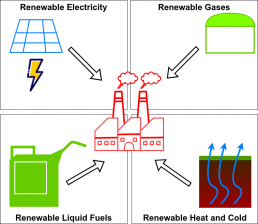

GOs - Challenges for specific energy carriers

The aim of this work package is to specifically analyse the particular challenges in the introduction or further development of RE verification systems for the energy forms electricity, gases, heating/cooling and liquid fuels. This research is divided into four sections, each of which deals with the specific circumstances, developments and challenges of one energy form. Each section contains an analysis of the relevant markets and the regulatory framework.

1. The market for electricity

Thanks to the strong growth of the green electricity market over many years, the electricity sector – along with the biomass market – has by far the most experience in the application and trading of guarantees of origin. To be able to build on this experience in designing the processes in the other energy sectors, the following current points of discussion will be further pursued:

1.1 Guarantees of origin for subsidised plants?

In Germany, renewable power whose generation is subsidised by the Renewable Energy Act (Erneuerbare-Energien-Gesetz, EEG) is not eligible for guarantees of origin: The renewable property of the subsidised electricity is distributed among all payers of the EEG surcharge. Since changing the financial basis of the EEG is currently being discussed, the question arises to what extent the ban on issuing GOs should be dropped for new plants, for which GOs could then constitute a further market-based remuneration component, complementing electricity market revenues.

1.2 Access to the GO register for large consumers

Should major power consumers be allowed to independently acquire and cancel GOs?

This option may be of particular interest to large commercial and industrial consumers as long-term power supply contracts from new plants (PPAs) are gaining in importance. Many such companies would like to be able to design and balance their own power supply without having to rely on a utility company. The consequences for the legally regulated electricity labelling and the underlying balancing of green electricity quantities are shown as an overview.

1.3 Handling and balancing of electricity GOs by storage systems

… especially if they are defined as consumers in regulatory terms. Power storage plants are set to become an even more important pillar of the energy supply. The balancing of inbound and outbound electricity, taking losses into account, requires a further development of the rules for electricity GOs. The same applies to grid losses, which so far cannot be assigned a green electricity property either. This can cause systematic distortions as the share of renewable power in the electricity mix increases. Storage and grid losses are also relevant for gas and heat supply systems, so consistent solution options are being investigated across sectors.

1.4 GOs for renewable energy consumed on site

Renewable power that is consumed at the site of generation is currently not eligible for GOs. Companies in particular have an interest in integrating such power into their CO2 accounting. In the case of charging stations for e-vehicles, no GOs can be generated from directly connected generation plants (mostly PV). Proof of green electricity is often a prerequisite for eligibility for public funds.

1.5 Dealing with GOs that were never issued

… because the renewable power plant was switched off by the grid operator as a redispatch or feed-in management measure. This problem already concerns the parties in PPA contracts today and will increase with the new regulation on redispatch practice according to §§ 13, 13a, 14 of the German Energy Industry Act, which has come into force in October 2021.

2. The market for green gases

The focus is on renewable gas (biomethane and hydrogen) distributed through the public gas grid. Biomethane is already established on the market in Germany, while renewable hydrogen is still in its infancy in terms of industrial use.

2.1 New impulses and challenges for renewable gases

While the EEG provided strong growth impulses for biomethane for many years, recently there has been stagnation. However, the stricter greenhouse gas reduction targets for the transport sector could provide new impetus for using biomethane as a fuel. The ambitious targets for renewable hydrogen set by the Renewable Energy Directive and the hydrogen strategy of the German government will be analysed. The new GOs for renewable gases envisaged by the Renewable Energy Directive will deeply affect the German market for green gases. The project aims to give stakeholders orientation regarding the new opportunities and challenges arising from this.

- opportunities, risks and fields of application of GOs for renewable gases

- possible labelling rules for green gas products

- the transferability of different certificates and the associated paths and registers of verification

3. The market for heating and cooling

Due to changes in the regulatory framework, a significant increase in the share of RE in the market for district heating and cooling is expected in the short to medium term. GOs could support the marketing of green district heating or cooling products in the future. Revenues from the balance-sheet supply of green district heating or cooling could support the decarbonisation of the grids. However, the implementation of a GO system must take into account the specific framework conditions of the heating and cooling markets.

3.1 Special issues of the heating market and its regulation:

- Should the labelling rules for renewable heat only allow GOs from physically connected heat grids or also GOs traded across grid boundaries?

- What is the relationship between heat GOs and the Member States' commitments to increase the share of renewable energy in heat grids?

- Can or should interfaces be created between GO systems and regulatory requirements or funding instruments?

4. The market for liquid renewable fuels

4.1 Climate-neutral travel thanks to synthetic fuels?

Liquid fuels are expected to be among the first use cases of synthetic energy carriers based on renewable energy, especially as a pathway to decarbonising the aviation industry. The large-scale use of renewable aviation fuels and corresponding certificates is envisaged in the German government’s hydrogen strategy with a view to climate-neutral travel. Such fuels could also replace oil in providing process heat in industrial applications. Therefore, options for the implementation of mass-balancing verification systems within the existing infrastructure will be examined.

4.2 The challenge of sector coupling interfaces

The RED offers a new system for drawing energy from the electricity grid. Synthetic liquid fuels may only qualify as renewable “provided that the electricity concerned has been supplied without taking electricity from the grid.” While a connection of the plant to the electricity grid is possible, the purchase of GOs does not suffice for verification; among other requirements, a temporal and spatial connection between the renewable electricity generation and fuel production must be proven. The GO4Industry project is investigating the challenges this poses for the verification system.